Invest in the best IPOs with the pros

Get the most valuable information about the IPO in one platform and make the right investment decisions together with experienced managers of the IPO hedge fund

-22.7%

-22.7%

-

NASDAQ BMBLTrade

Date 11.02.2021Price Range $37 - $39 -

Industry TechnologyDeal Size $2150 млн.Underwriter Morgan Stanley

-62.2%

-62.2%

-

NASDAQ DSPTrade

Date 10.02.2021Price Range $22 - $24 -

Industry TechnologyDeal Size $250 млн.Underwriter Morgan Stanley

-34.6%

-34.6%

-

NASDAQ SANATrade

Date 04.02.2021Price Range $23 - $24 -

Industry TechnologyDeal Size $587.5 млн.Underwriter Morgan Stanley

781.1%

781.1%

-

NASDAQ UPSTTrade

Date 16.12.2020Price Range $20 - $22 -

Industry TechnologyDeal Size $240.31 млн.Underwriter Morgan Stanley

24.8%

24.8%

-

NASDAQ BCABTrade

Date 16.12.2020Price Range $15 - $17 -

Industry TechnologyDeal Size $189 млн.Underwriter Morgan Stanley

15.1%

15.1%

-

NASDAQ CERTTrade

Date 11.12.2020Price Range $19 - $22 -

Industry TechnologyDeal Size $668.27 млн.Underwriter Morgan Stanley

166%

166%

-

NASDAQ ABNBTrade

Date 10.12.2020Price Range $56 - $60 -

Industry TechnologyDeal Size $3490 млн.Underwriter Morgan Stanley

16.8%

16.8%

-

NASDAQ SEERTrade

Date 04.12.2020Price Range $16 - $18 -

Industry TechnologyDeal Size $175 млн.Underwriter Morgan Stanley

184.7%

184.7%

-

NYSE SNOWTrade

Date 16.09.2020Price Range $100 - $110 -

Industry TechnologyDeal Size $3360 млн.Underwriter Morgan Stanley

Unique IPO evaluation algorithm based on the research and analysis of over 3500 IPOs on the NYSE and NASDAQ

PROIPO Smart Rating consolidates all key figures that historically have had significant impact on the IPO success, and gives the final independent expert review

-

VERY BULLISHName Ticker Change (3M)

- Upstart Holdings UPST +526%

- Airbnb ABNB +208%

- Snowflake SNOW +178%

-

BULLISHName Ticker Change (3M)

- BioAtla BCAB +277%

- Corsair Gaming CRSR +113%

- AbCellera Biologics ABCL +89%

-

NEUTRALName Ticker Change (3M)

- McAfee MCFE -3.6%

- Acutus Medical AFIB +36.4%

- Sprout Social SPT -14%

What you get from the service?

Important financial KPIs of the company

Most essential financial data and ratios

Historical tracking of venture capital investments

Smart Rating 2019

-

0 VERY BULLISH

-

0

Trades brought investors a profit on the 1st trading day

-

0

Profitable trades in the period of 90 days

-

0

Average return on a trade in the period of 90 days

-

-

0 BULLISH

-

0

Trades brought investors a profit on the 1st trading day

-

0

Profitable trades in the period of 90 days

-

0

Average return on a trade in the period of 90 days

-

-

0 NEUTRAL

-

0

Trades brought investors a profit on the 1st trading day

-

0

Profitable trades in the period of 90 days

-

0

Average return on a trade in the period of 90 days

-

Choose your subscription plan

Get access to important financial metrics and make right investment decisions-

IPO $ 59

-

PROIPO Smart Rating

Details

PROIPO Smart Rating consolidates all paramount data that historically have had significant impact on the IPO success/failure, and gives the final autonomous, transparent & easy-to-understand verdict on the IPO. -

Paramount KPIs & financials of the company

Details

- Important Notes on IPO

- IPO Market Sentiment Indicator

- Updates on the demand level of the Institutional Investors

- Allocation indicator

- Indicative prices before the trading is open

- Analyst expectations

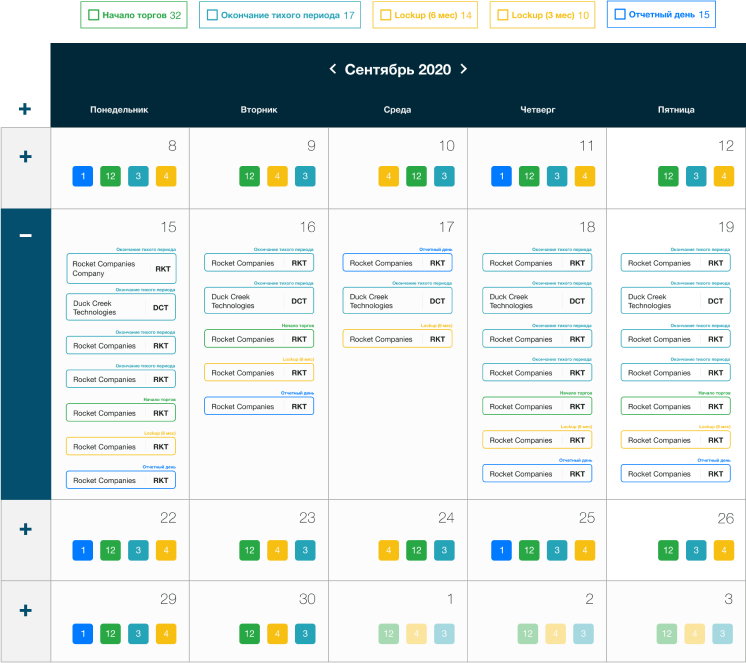

- IPO Calendar

- Important Telegram Alerts

- Historical tracking of venture capital investments

- Key financial KPIs and ratios

- Statistics of the last 10 IPOs from the sector

- Analyst recommendations after the end of the quiet period

-

Trading $ 79IPO $ 99IPO + Trading $ 149

-

PROIPO Smart Rating

Details

PROIPO Smart Rating consolidates all paramount data that historically have had significant impact on the IPO success/failure, and gives the final autonomous, transparent & easy-to-understand verdict on the IPO. -

Paramount KPIs & financials of the company

Details

- Crucial Notes on IPO

- IPO Market Sentiment Indicator

- Institutional Investor Demand

- Allocation indicator

- Indicative prices before the trading is open

- Analysts' expectations

- Key events Calendar on the IPO market

- Important Telegram Alerts

- Track record of the venture capital investments

- Key financial KPIs and ratios

- Last 10 closed deals from the sector

- Recommendations from the analysts once the quiet period is over

-

Trading signals

Details

Promptly receive signals to buy and sell securities from the secondary market IPO on the website & PROIPO-owned Telegram channel. -

Choose Discount 16%

-

Trading $ 213IPO $ 267IPO + Trading $ 384

-

PROIPO Smart Rating

Details

PROIPO Smart Rating consolidates all paramount data that historically have had significant impact on the IPO success/failure, and gives the final autonomous, transparent & easy-to-understand verdict on the IPO. -

Paramount KPIs & financials of the company

Details

- Crucial Notes on IPO

- IPO Market Sentiment Indicator

- Institutional Investor Demand

- Allocation indicator

- Indicative prices before the trading is open

- Analysts' expectations

- Key events Calendar on the IPO market

- Important Telegram Alerts

- Track record of the venture capital investments

- Key financial KPIs and ratios

- Last 10 closed deals from the sector

- Recommendations from the analysts once the quiet period is over

-

Trading signals

Details

Promptly receive signals to buy and sell securities from the secondary market IPO on the website & PROIPO-owned Telegram channel. -

Choose Discount 10%Choose Discount 10%Choose Discount 20%

-

Trading $ 805IPO $ 1009IPO + Trading $ 1360

-

PROIPO Smart Rating

Details

PROIPO Smart Rating consolidates all paramount data that historically have had significant impact on the IPO success/failure, and gives the final autonomous, transparent & easy-to-understand verdict on the IPO. -

Paramount KPIs & financials of the company

Details

- Crucial Notes on IPO

- IPO Market Sentiment Indicator

- Institutional Investor Demand

- Allocation indicator

- Indicative prices before the trading is open

- Analysts' expectations

- Key events Calendar on the IPO market

- Important Telegram Alerts

- Track record of the venture capital investments

- Key financial KPIs and ratios

- Last 10 closed deals from the sector

- Recommendations from the analysts once the quiet period is over

-

Trading signals

Details

Promptly receive signals to buy and sell securities from the secondary market IPO on the website & PROIPO-owned Telegram channel. -

Choose Discount 15%Choose Discount 15%Choose Discount 25%

Have questions?

- General

- Smart Rating

- Subscription

- Payment

-

What is PROIPO?

PROIPO is an independent online service for analyzing and evaluating IPOs on NYSE and NASDAQ, based on a unique IPO evaluation algorithm. The algorithm is based on research and analysis of 3500+ IPOs on NYSE and NASDAQ for more than 10 years using Big Data analysis methods. The PROIPO Rating gives an estimate of the probability of success for the given placement (statistics).

-

Who developed the service?

The service is developed by hedge fund managers with extensive experience (over 15 years) in investing in the stock markets, and over 7 years experience in IPO investments.

-

What will I get from PROIPO service?

- weekly calendar of upcoming IPOs, end of the quiet period, lock-up period;

- up-to-date and reliable data for each placement;

- important notifications: changes in the price range, deal volume, end of the quiet period, end of the lock-up period;

- an overview of the key financial data of the company;

- IPO market sentiment;

- level of demand of the institutional investors (available in a paid subscription);

- Wall Street analysts' expectations (available as a paid subscription);

- exclusive PROIPO SMART RATING - consolidated final rating (available in a paid subscription);

- change in indicative prices before the trading is open. -

Who is the service designed for? Our mission.

The service is developed for both individual investors and professional communities in order to provide people with high-quality and complete information about upcoming IPOs in a convenient and easy-to-understand form. Our mission is to empower people to choose the best IPOs based on objective information and not on the subjective opinion of analysts.

-

Where do you get financial data?

All financial data is taken from the official website of the Securities and Exchange Commission SEC.GOV. Before going public, companies submit a prospectus (Form S-1) to the Securities and Exchange Commission.

-

How does PROIPO SMART RATING work?

PROIPO SMART RATING consolidates all key figures that historically have had significant impact on the IPO success, and gives the final independent expert review.

There are 3 types of ratings:

Very Bullish – companies with the highest probability of success and high IPO returns (companies with similar rating: Beyond Meat, Zoom, Black Diamond Therapeutics, Bill.com, Datadog, Pager Duty, Crowd Strike, etc.)

Bullish – companies with high probability of IPO success (companies with similar rating: Shock Wave Medical, Levi Strauss, Chewy, Ping Identity, XP, etc.)

Neutral – companies with low probability of IPO success (Peloton Interactive, Smile Direct Club, Sprout Social, etc.)The history of PROIPO ratings of already listed companies is available in the Placed IPOs section.

-

How are the “Level of demand of Institutional Investors” and “Analyst Expectations” indicators formed?

One of the key success criteria for IPO is the level of demand (oversubscription) for the company's shares from major market players and the expectations of leading Wall Street analysts.

Strong long-lasting relationships with the international counterparties (brokers and funds) enable us to provide PROIPO users with objective information on the level of demand and expectations and provide it in a user-friendly form.

-

How does the Market Sentiment Indicator work?

The IPO Market Sentiment Indicator provides clear understanding of whether it's time to invest in the IPO. There have been cases when the company met all the criteria for a successful IPO, but due to negative market sentiment, the placement did not have significant success. We analyze various market sentiment criteria and consolidate them into a single metric.

-

Does PROIPO have a refund policy in case I decide to unsubscribe after the payment has been made?

We do not practice refunds due to the fact that paid users immediately benefit from the statistics and analytics they purchase.

-

Can I apply for the refund if there is no IPO for the paid period?

If there's no IPO published on the proipo.pro website during the paid period, please e-mail to support@proipo.pro in order to apply for a free renewal of your subscription.

-

Does PROIPO provide a free trial?

There is no free trial, but if you doubt the objectivity of the data provided on the upcoming IPO, the track record of previous analytical data is available under the paid subscription in the Placed IPOs section. The Weekly subscription plan is also an option for new users as a less costly alternative to evaluate the quality of our services before you decide to cooperate with us on a longterm basis.

-

How justified is the price for a PROIPO subscription?

In comparison with similar services, proipo.pro provides a more complete and high-quality set of information at a more affordable price.

-

How can I trust the service? Are there any statistics?

The history of PROIPO ratings of already listed companies is available in the Placed IPOs section. This is the archive of the information provided by paid subscription, you are always welcome to evaluate the results.

-

What are the payment methods for a PROIPO subscription?

At the moment, we cooperate with the PayPal payment system, which allows you to pay easily and safely.